Why Aren'T Federal Taxes Being Withheld 2024

Why Aren'T Federal Taxes Being Withheld 2024. Here are some possible reasons why your employer didn’t withhold federal taxes withheld (or even state taxes):. Don't like your 2024 tax refund?

4 reasons why you may have had no federal taxes withheld. What if i don’t pay enough on time?

Can I Get An Extension?

Don't like your 2024 tax refund?

Here Are A Few Reasons Why No Federal Income Tax May Be Withheld From Your Paycheck.

I appreciate you reaching out to us, @cboler.

Tax Deductions, Tax Credit Amounts, And.

Images References :

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg) Source: www.investopedia.com

Source: www.investopedia.com

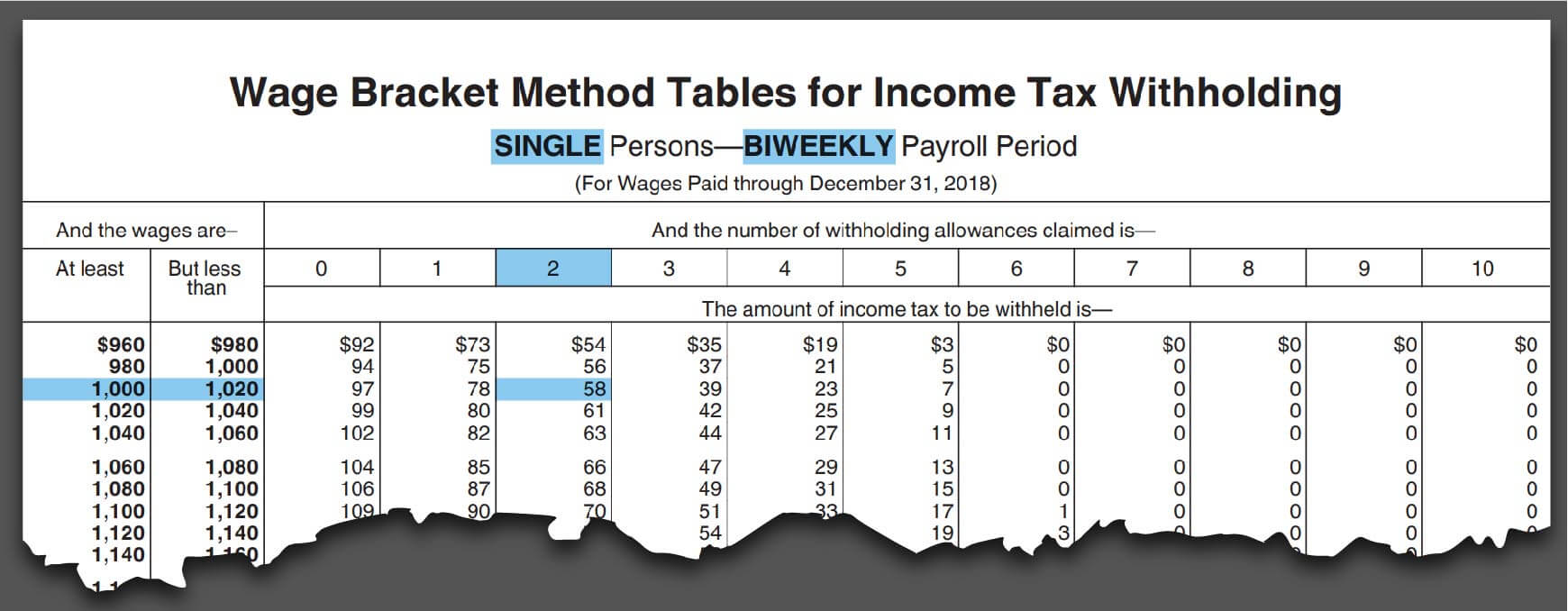

Withholding Tax Explained Types and How It's Calculated, How could i file my taxes directly with the irs for free? In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

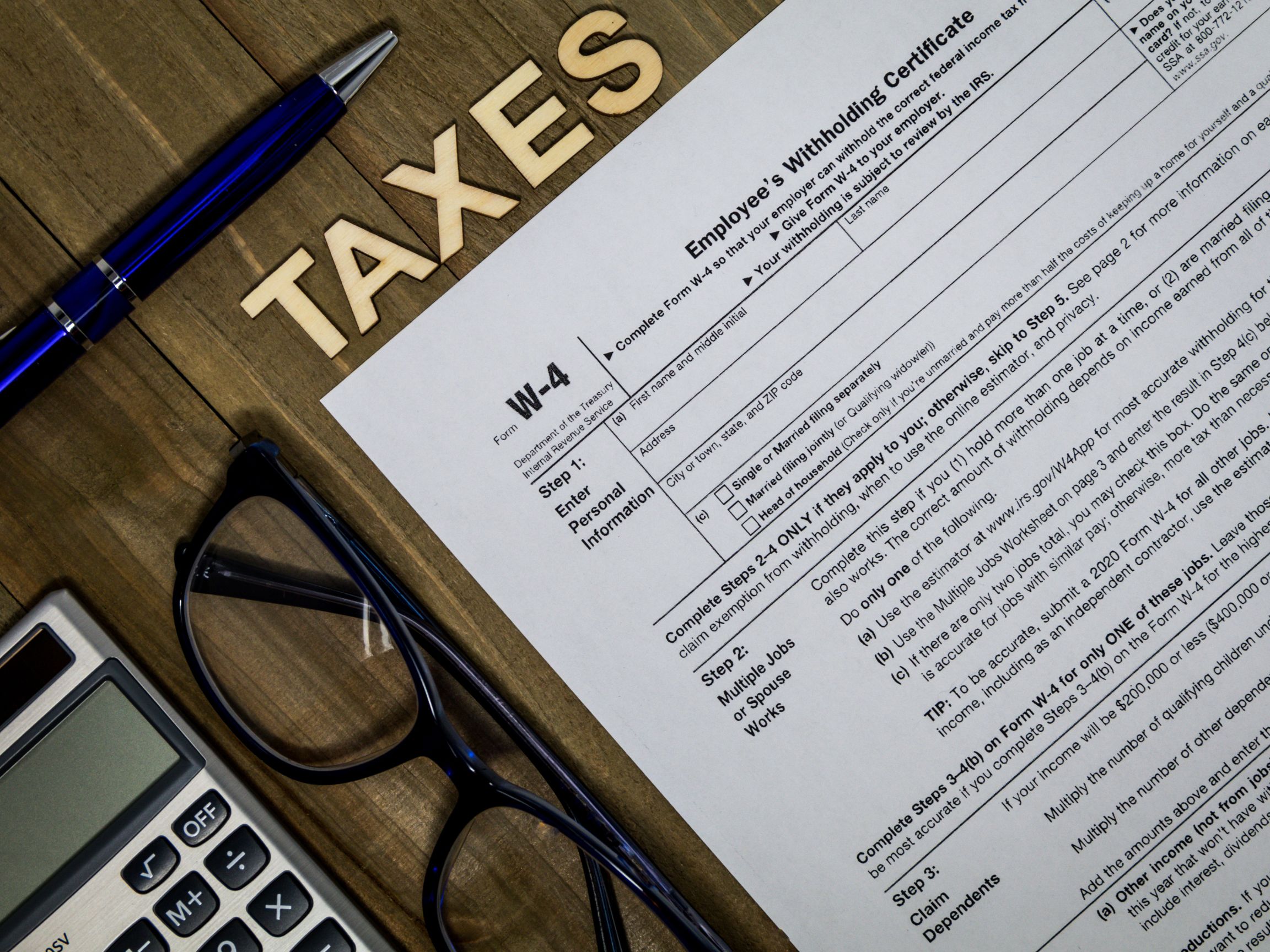

Federal Tax Withholding Employer Guidelines and More, Here's an easy way to get a. Let's go over your payroll setup so we can identify why the federal taxes are.

Source: www.payrollpartners.com

Source: www.payrollpartners.com

Why Was Federal Withholding Not Taken From My Paycheck?, Here are a few reasons why no federal income tax may be withheld from your paycheck. What’s the deadline to file my taxes this year?

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is Federal Tax? Withholding Guidelines and More, What if i don’t pay enough on time? What do i need to know about withholding and estimated taxes?

Source: www.kiplinger.com

Source: www.kiplinger.com

Tax Withholding Changes Can Boost Your Paycheck Kiplinger, Tax deductions, tax credit amounts, and. If the yearly supplemental income is over $1 million, it is subject to 37%.

Source: www.nbcnews.com

Source: www.nbcnews.com

Here's where your federal tax dollars go NBC News, Tax brackets for different filing statuses, how the tax brackets really work, and most importantly, why your taxes could actually go. If the yearly supplemental income is over $1 million, it is subject to 37%.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

What Is Federal Tax Withholding?, Here's an easy way to get a. Even when everything runs smoothly,.

Source: www.bankrate.com

Source: www.bankrate.com

Tax Withholding Definition When And How To Adjust IRS Tax Withholding, Let's go over your payroll setup so we can identify why the federal taxes are. For the 2024 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000;

Source: www.bankrate.com

Source: www.bankrate.com

How And Why To Adjust Your IRS Tax Withholding Bankrate, In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Here are a few reasons why no federal income tax may be withheld from your paycheck.

Source: www.aol.com

Source: www.aol.com

What Are the 20202021 Federal Tax Brackets and Tax Rates?, Tax deductions, tax credit amounts, and. Even when everything runs smoothly,.

4 Reasons Why You May Have Had No Federal Taxes Withheld.

Can i get an extension?

Find Details On Tax Filing Requirements With Publication 501,.

Here are a few reasons why no federal income tax may be withheld from your paycheck.